The Low Down on Ponzi Schemes

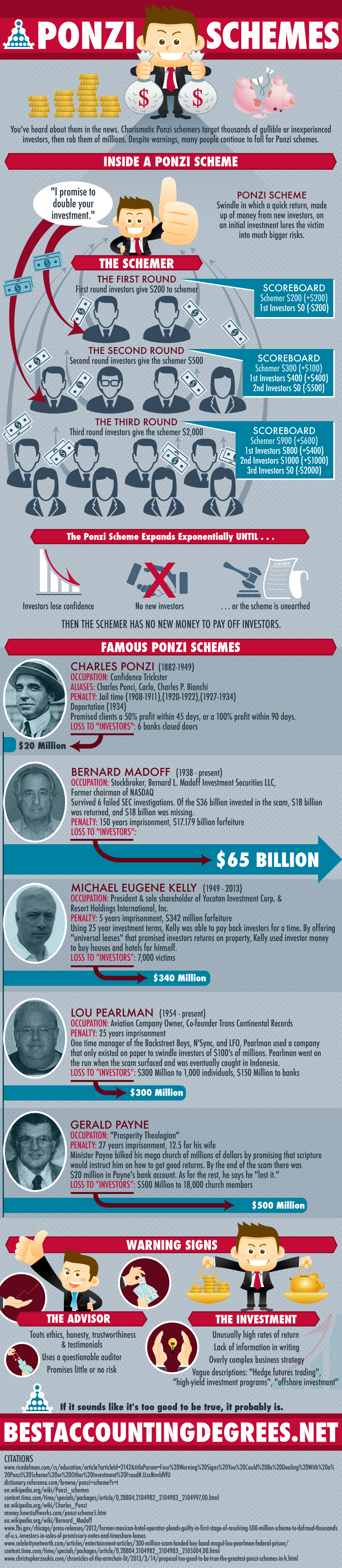

You’ve heard about them in the news. Charismatic Ponzi schemers target thousands of gullible or inexperienced investors, then rob them of millions. Despite warnings, many people continue to fall for Ponzi schemes.

Inside a Ponzi Scheme

A Ponzi Scheme is a swindle in which a quick return, made up of money from new investors, on an initial investment lures the victim into much bigger risks.

Lets pick that apart:

The schemer: “I promise to double your investment.”

The First Round:

First round investors give $200 to schemer

Scoreboard:

Schemer-$200 (+$200)

1st round investors-$0 (-$200)

The Second Round:

Second round investors give the schemer $500

Scoreboard:

Schemer-$300 (+$100)

1st round investors-$400 (+$400)

2nd round investors-$0 (-$500)

The Third Round:

Third round investors give the schemer $2000

Scoreboard:

Schemer-$900 (+$600)

1st round investors-$800 (+$400)

2nd round investors-$1000 (+$1000)

3rd round investors-$0 (-$2000)

The Ponzi scheme expands exponentially

…Until…

1.) Investors lose confidence

2.) Or, no new investors

3.) Or, the scheme is unearthed

Then the schemer has no new money to pay off investors.

Where Ponzi Schemes Started

Charles Ponzi:

1882-1949

Occupation: Confidence Trickster

Aliases: Charles Ponci, Carlo, Charles P. Bianchi

Loss to “investors”: $20 million, 6 banks closed doors.

Penalty: 3 years (1908-1911), 5 years federal(1920-1922),9 years state (1927-1934), deportation (1934)

Mr. Ponzi– for which the scheme is named– promised clients a 50% profit within 45 days, or a 100% profit within 90 days. His business plan involved buying discounted postal reply coupons in other countries and redeeming them for face value in the US. In reality he was paying himself and early investors with the money from later investors.

So that’s how they work, so why do we keep on falling for them?

Personality, and greed.

Famous Ponzi Schemers

1.) The namesake himself, Charles Ponzi

2.) Bernard Madoff:

1938-present

Occupation: Stockbroker, Bernard L. Madoff Investment Securities LLC,chairman of NASDAQ (former)

Loss to “investors”: $65 billion in stated gains

Penalty: 150 years imprisonment, $17.179 billion forfeiture

Mr. Madoff survived 6 failed SEC investigations over at least 20 years of Ponzi scheming. Madoff deposited investor money into a Chase account, when investors wanted their money, he would return their money or the money of other clients to them. Some clients came out ahead, while others lost everything. Of the $36 billion invested in the scam, $18 billion was returned, and $18 billion was missing.

3.) Michael Eugene Kelly:

1949-2013

Occupation: president and sole shareholder of Yucatan Investment Corp. and Resort Holdings International Inc

Loss to investors: $340 million to 7,000 victims

Penalty: 5 years imprisonment, $342 million forfeiture

Mr. Kelly sold two types of investments: a nine-month promissory note, and a so-called “universal lease.” Using investor money to buy cars, houses, and hotels, Kelly offered investors the option to use hotel rooms, rent rooms, or allow third-party managers to use the room. The third option gave annual returns up to 11%. Using 25 year terms on investments, Kelly was able to pay back investors for a time.

4.) Lou Pearlman

1954-present

Occupation: Aviation Company Owner, Co-founder Trans Continental Records

Loss to investors: $300 million to 1000 individuals, $150 million to banks.

Penalty: 25 years imprisonment

This swindler was the cousin of Art Garfunkel and the one time manager of the Backstreet Boys, N’Sync and LFO. He also used a company that only existed on paper–Transcontinental Airline Travel Services– to swindle investors out of hundreds of millions of dollars. When word of the scam surfaced, Mr. Pearlman went on the run, but was eventually spotted by savvy tourists at a luxury hotel in Indonesia.

5.) Gerald Payne

Occupation: “Prosperity Theologian”

Loss to investors: $500 million to 18,000 church members

Penalty: 27 years imprisonment, 12.5 for his wife

Minister Payne helped run Greater Ministries International, and bilked his megachurch of millions of dollars by promising that scripture would instruct him on how to offer good returns. Depositing scores of checks right below the $10,000 reporting limit into his bank account, Payne came away with $20 million. As for the rest, he says he “lost it.”

Ponzi Scheme Warning Signs

The Adviser:

- Touts ethics, honesty, trustworthiness

- Uses a questionable auditor

- Touts testimonials.

- Promises little or no risk.

The Investment:

- Unusually high or steady rates of return

- Lack of information in writing

- Involves overly complex business strategy

- Vague descriptions: “Hedge futures trading”, “high-yield investment programs”, “offshore investment”

Remember that you’re the customer, and it’s your financial adviser’s responsibility to honestly and clearly explain your investments.

If it sounds like it’s too good to be true, it probably is.

Citations:

- http://www.ricedelman.com/cs/education/article?articleId=2142&titleParam=Four%20Warning%20Signs%20You%20Could%20Be%20Dealing%20With%20a%20Ponzi%20Scheme%20or%20Other%20Investment%20Fraud#.UzxNnvldVfU

- http://dictionary.reference.com/browse/ponzi+scheme?s=t

- http://en.wikipedia.org/wiki/Ponzi_schemes

- http://content.time.com/time/specials/packages/article/0,28804,2104982_2104983_2104997,00.html

- http://en.wikipedia.org/wiki/Charles_Ponzi

- http://money.howstuffworks.com/ponzi-scheme5.htm

- http://en.wikipedia.org/wiki/Bernard_Madoff

- http://www.fbi.gov/chicago/press-releases/2012/former-mexican-hotel-operator-pleads-guilty-in-first-stage-of-resolving-500-million-scheme-to-defraud-thousands-of-u.s.-investors-in-sales-of-promissory-notes-and-timeshare-leases

- http://www.celebritynetworth.com/articles/entertainment-articles/300-million-scam-landed-boy-band-mogul-lou-pearlman-federal-prison/

- http://content.time.com/time/specials/packages/article/0,28804,2104982_2104983_2105004,00.html

- http://www.christopherzoukis.com/chronicles-of-the-armchair-lit/2013/3/14/proposal-too-good-to-be-true-the-greatest-ponzi-schemes-in-h.html